Reverting to the norm?

The average prices for May 2017 are in, and the results are getting a lot of attention. Buyers seem to be lining up into two camps – the “wait-and-see” school, and the “fortune-favours-the-bold” group. Sellers, meanwhile, are understandably confused.

Is it still a sellers’ market?

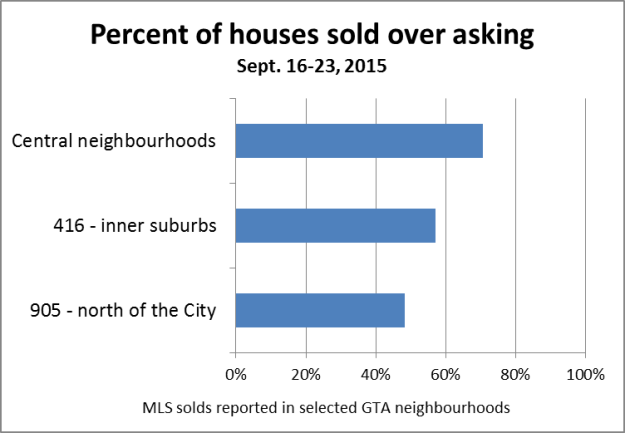

Yes. There are many more buyers than sellers, and homes are selling quickly, usually over asking. The average selling price of all GTA homes was $863,910 in May, about 15% up over last May. In many neighbourhoods, detached and semi-detached homes were getting sale prices between 25% and 30% higher than last spring.

Sellers are not all of the same mind. Some genuinely need to sell at this time, while others will have been attracted by the notion of cashing out. This diversity of motives can be confusing. Asking prices are also all over the map. On any given street, one house can be priced drastically under its likely selling price; while another comparable house can come out the same week priced hundreds of thousands of dollars higher. Buyers (and their agents) then have to unravel the conflicting narratives and determine where the likely values are.

Should I buy or should I wait?

This question never gets old. If you have a good reason to buy, and you have a budget set, then yes, buy. Don’t buy just any old thing that comes up in your price range, but buy the home that makes sense for you. If the only homes you want are priced out of your range, then do some soul-searching. Can you alter your criteria? Will your purchasing power increase significantly, or will your needs change in a few years?

If you’re buying a property to live in, think long and hard about how well a home can serve your needs for at least three to five years. “Buy the home and not the price.” It’s not all about price in this market. A qualified home buyer can have choices, and (especially if you’re a first-time buyer) you may need to talk with an experienced Realtor to fully evaluate your options.

If you’re buying a property primarily as an investment, then your criteria will be drastically different and you will be seeking financial and tax advice.

Expert advice – at your fingertips

In a rapidly changing market, you need smart, timely advice, whether you’re a buyer or a seller.

We relish challenges, we like to share, and we’re available to help… You can email us, or ask for James and Joanne at 416-483-8000.